singapore property market prices with cooling measures since 2010.

Description

# Singapore Property Market Prices with Cooling Measures Since 2010

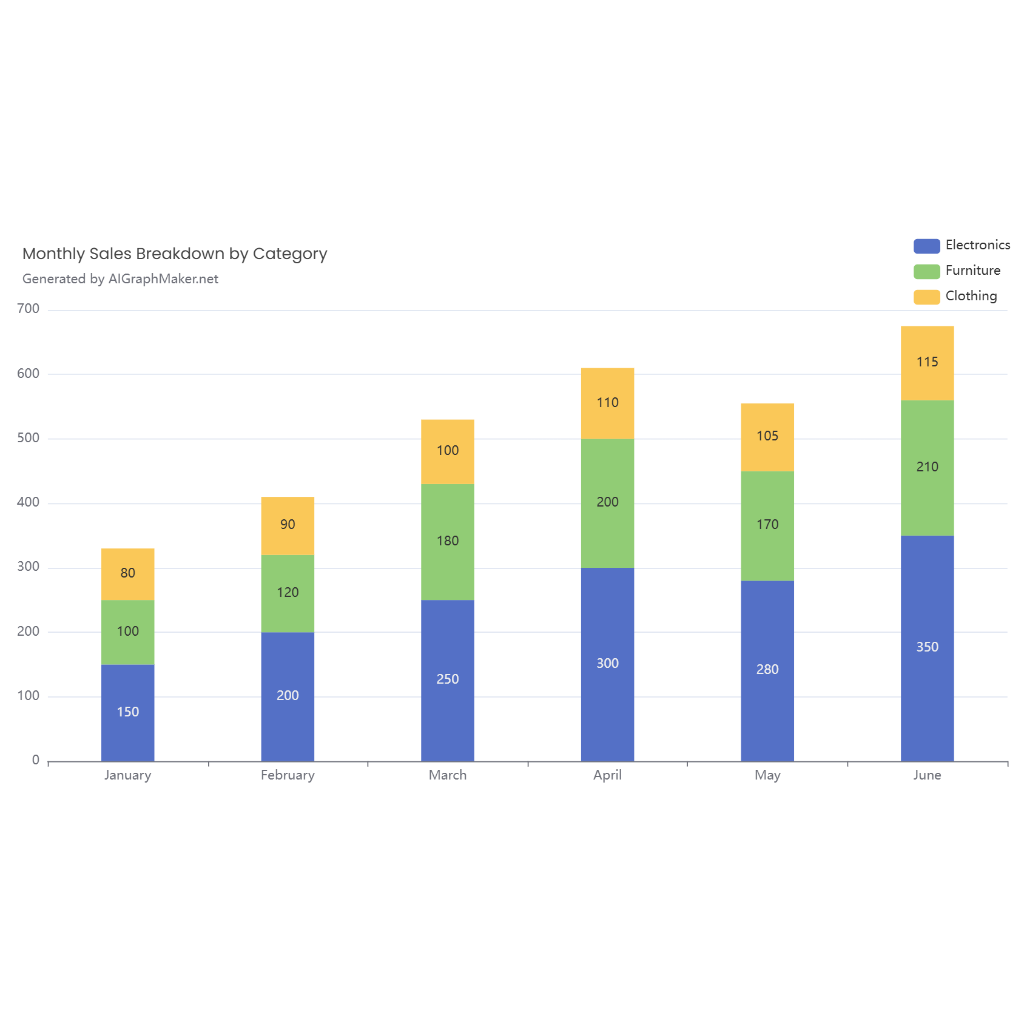

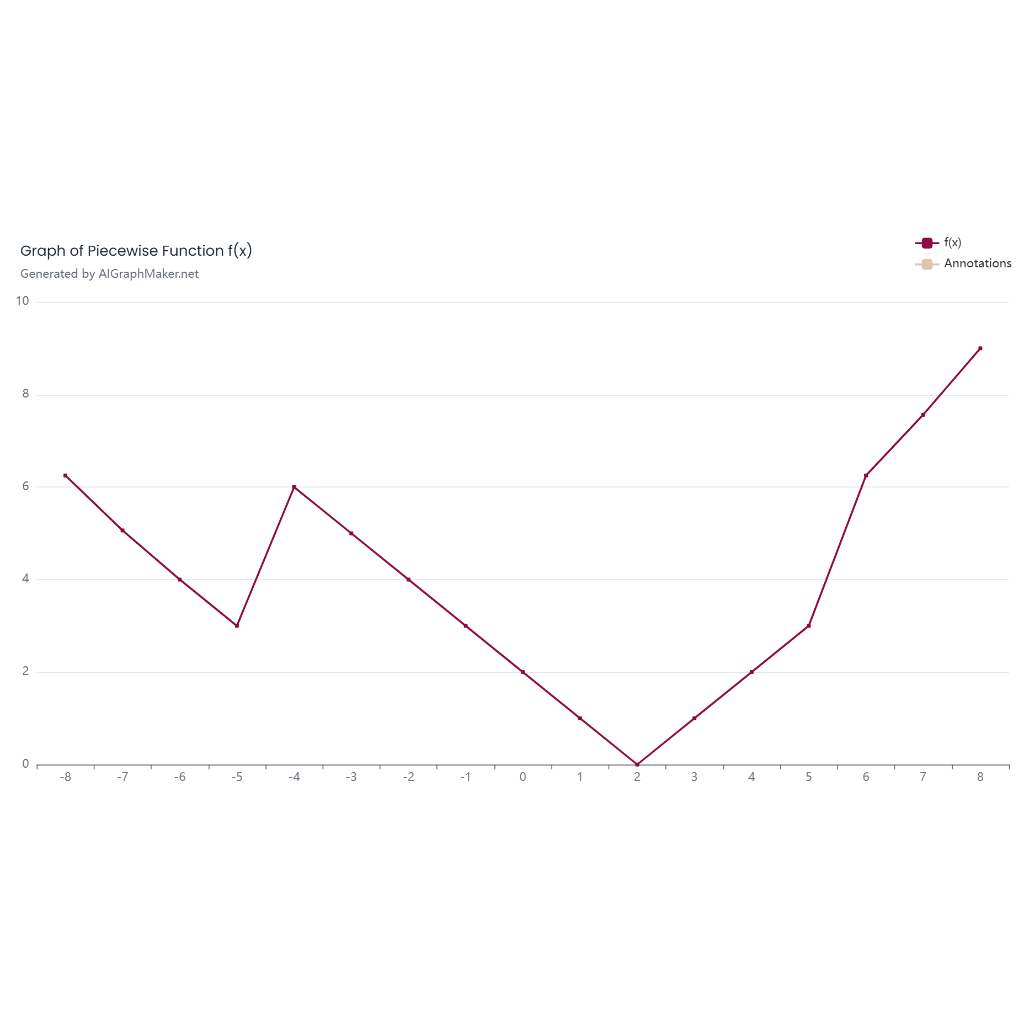

## Market Trends

The Singapore property market has experienced fluctuating trends since 2010. In 2010, the property price index for private residential properties rose by 4.95% in Q1, 4.05% in Q2, 1.71% in Q3, and 1.80% in Q4. From 2011 to 2013, the market generally showed a fluctuating trend with slight growth or decline in property prices. In 2014 and 2015, property prices experienced a slight decline. In 2016 and 2017, property prices still showed a fluctuating trend with slight growth or decline. In 2018, property prices rose by 3.71% in Q1, 3.42% in Q2, 0.10% in Q3, and dropped by 0.02% in Q4. In 2019, property prices fell by 0.86% in Q1, rose by 1.21% in Q2, 1.39% in Q3, and 0.29% in Q4. In 2020, property prices decreased by 0.91% in Q1, rose by 1.15% in Q2, 0.40% in Q3, and 1.69% in Q4. In 2021, property prices increased by 2.49% in Q1, 0.09% in Q2, 0.53% in Q3, and 3.41% in Q4. In 2022, property prices dropped by 0.96% in Q1, rose by 1.47% in Q2, 1.86% in Q3, and fell by 0.48% in Q4. In 2023, property prices rose by 2.07% in Q1, fell by 1.17% in Q2, dropped by 0.12% in Q3, and rose by 1.97% in Q4. In 2024, property prices increased by 1.21% in Q1, 0.28% in Q2, dropped by 1.24% in Q3, and rose by 2.07% in Q4.

## Cooling Measures

Since 2010, the Singapore government has implemented a series of cooling measures to stabilize the property market and curb speculative activities. Below is a list of some key cooling measures:

- **February 2010**: Reintroduced the Seller’s Stamp Duty (SSD) policy. Properties sold within one year were subject to a 3% SSD. The Loan-to-Value (LTV) limit was reduced from 90% to 80%.

- **August 2010**: The SSD policy was expanded to include properties sold within three years. For property buyers with existing housing loans, the LTV limit was reduced to 70%, and the minimum cash down payment requirement was increased to 10%.

- **January 2011**: The holding period for SSD was increased from three years to four years. SSD rates were raised to 16%, 12%, 8%, and 4% of the consideration for properties sold in the first, second, third, and fourth year of purchase, respectively. The LTV limit for non-individual property purchasers was lowered to 50%, and for individuals with one or more outstanding housing loans, the LTV limit was reduced from 70% to 60%.

- **December 2012**: Additional Buyer’s Stamp Duty (ABSD) rates were increased. For foreigners, the ABSD rate rose from 10% to 15%, and for entities, from 15% to 20%. The Minimum Occupation Period (MOP) for HDB resale flats was extended from three years to five years.

- **July 2013**: The Total Debt Servicing Ratio (TDSR) framework was introduced, limiting monthly debt obligations, including home loans, to no more than 55% of a buyer’s income.

- **March 2014**: The government announced that from April 1, 2014, housing loans under the Housing & Development Board (HDB) Concessionary Loan Scheme would be subject to the TDSR framework. The income ceiling for HDB loans was lowered from SGD 10,000 to SGD 8,000. The LTV limit for HDB resale loans was reduced to 75%.

- **May 2015**: The government announced that from June 1, 2015, the LTV limit for housing loans granted by financial institutions regulated by the Monetary Authority of Singapore (MAS) to HDB flat buyers would be lowered from 75% to 70%.

- **January 2016**: From January 1, 2016, the government adjusted the ABSD rates. For Singapore citizens purchasing their second property, the ABSD rate increased from 12% to 16%, and for their third and subsequent properties, from 25% to 30%. For permanent residents purchasing their second property, the ABSD rate rose from 15% to 20%, and for their third and subsequent properties, from 30% to 35%. For foreigners, the ABSD rate increased from 20% to 30%, and for entities, from 30% to 35%.

- **July 2018**: The government announced new cooling measures. For Singapore citizens purchasing their second property, the ABSD rate rose from 12% to 17%, and for their third and subsequent properties, from 25% to 30%. For permanent residents purchasing their second property, the ABSD rate increased from 15% to 20%, and for their third and subsequent properties, from 30% to 35%. For foreigners, the ABSD rate rose from 30% to 40%, and for entities, from 35% to 40%. The LTV limit for housing loans granted by financial institutions regulated by MAS was reduced from 80% to 75%.

- **December 2021**: Additional Buyer’s Stamp Duty (ABSD) rates were increased across the board. For foreigners, the ABSD rate rose from 40% to 60%. The Total Debt Servicing Ratio (TDSR) threshold was tightened from 55% to 50%.

- **October 2022**: ABSD rates were raised again. For Singapore citizens purchasing their second property, the ABSD rate increased from 17% to 20%, and for their third and subsequent properties, from 30% to 35%. For permanent residents purchasing their second property, the ABSD rate rose from 20% to 30%, and for their third and subsequent properties, from 35% to 40%. For foreigners, the ABSD rate increased from 60% to 60%, and for entities, from 40% to 60%.

## Impact of Cooling Measures

- **Moderation in Price Growth**: Cooling measures have played a key role in moderating the growth of private property prices. For instance, the introduction of the Additional Buyer’s Stamp Duty (ABSD) in 2011 marked a turning point, slowing the rapid increase in property values. Between 2009 and 2013, private residential prices surged by 62%. However, post-2013, growth slowed significantly, with prices rising by only 15% over the following decade, according to data from the Urban Redevelopment Authority (URA).

- **Shift in Buyer Behavior**: Cooling measures have significantly reduced foreign investment in Singapore’s property market. With ABSD rates for foreigners climbing to 60% in 2023, foreign buyers now account for just 4% of private property transactions—down from 20% in 2011. For local buyers, tighter financial regulations like the Total Debt Servicing Ratio (TDSR) framework have prompted greater caution. First-time buyers and upgraders are prioritising affordability, opting for smaller loans and properties within their means.

- **Impact on Developers**: Developers have responded by scaling down project launches to avoid penalties on unsold units under the ABSD framework. This approach ensures that supply aligns more closely with current demand. Developers are also targeting affluent local buyers by offering luxury properties with premium amenities. Additionally, they are introducing smaller unit sizes to cater to younger buyers and single professionals with limited budgets.

These cooling measures have been instrumental in stabilizing Singapore’s property market, preventing overheating, and ensuring housing remains accessible for Singaporeans.