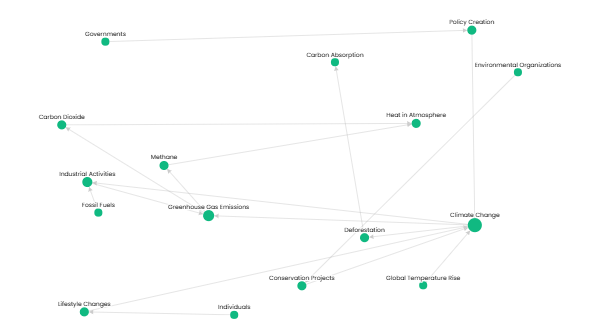

"The stock market is influenced by multiple factors, including economic indicators, corporate earnings reports, interest rates, and geopolitical events. When companies report strong earnings, their stock prices generally rise, leading to overall market growth. Conversely, high interest rates often lead to a decline in stock prices as borrowing becomes more expensive. Geopolitical events like trade wars or elections can also create uncertainty, causing fluctuations in stock market performance. Investors closely monitor these indicators to predict future market movements.

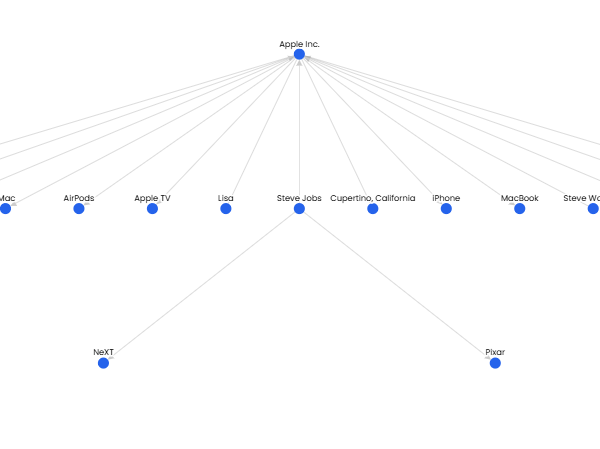

Entities and their types:

Stock Market - Concept

Economic Indicators - Concept

Corporate Earnings Reports - Concept

Interest Rates - Concept

Geopolitical Events - Concept

Companies - Entity

Stock Prices - Concept

Investors - Person

Trade Wars - Event

Elections - Event

Relationships:

Stock Market - Influenced by - Economic Indicators

Stock Market - Influenced by - Corporate Earnings Reports

Stock Market - Influenced by - Interest Rates

Stock Market - Influenced by - Geopolitical Events

Strong Earnings - Lead to - Rising Stock Prices

Weak Earnings - Lead to - Falling Stock Prices

High Interest Rates - Lead to - Declining Stock Prices

Low Interest Rates - Lead to - Rising Stock Prices

Geopolitical Events - Lead to - Market Fluctuations

Trade Wars - Lead to - Market Uncertainty

Elections - Lead to - Market Volatility

Investors - Monitor - Economic Indicators

Investors - Monitor - Corporate Earnings Reports

Investors - Monitor - Interest Rates

Investors - Monitor - Geopolitical Events

Stock Market - Affected by - Global Events

Companies - Release - Earnings Reports

Companies - Affected by - Economic Indicators

Companies - Affected by - Interest Rates

Investors - Predict - Market Movements

Description

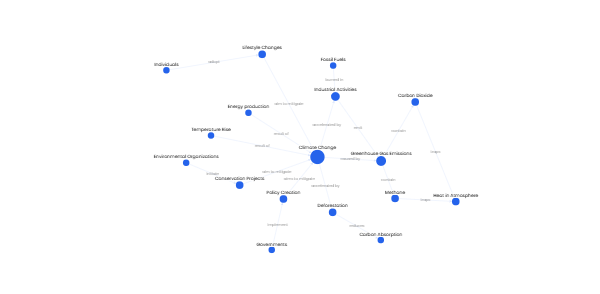

## Key Factors and Their Relationships

The stock market is a complex system influenced by a multitude of factors that can cause its performance to fluctuate. Below is a breakdown of the major factors and how they interrelate:

### Economic Indicators

Economic indicators are vital signs of a country's economic health and have a significant impact on the stock market. These include metrics such as GDP growth, inflation rates, unemployment rates, and consumer confidence indices. For example, if GDP growth is strong and unemployment rates are low, this typically indicates a healthy economy. Companies are likely to perform well in such an environment, leading to increased investor confidence and a rise in stock prices. Conversely, high inflation can erode purchasing power and reduce corporate profits, potentially causing stock prices to decline.

### Corporate Earnings Reports

The performance of individual companies, as reflected in their corporate earnings reports, directly affects their stock prices and can influence the broader market. When companies report strong earnings that exceed market expectations, it signals good financial health and growth potential. This often leads to an increase in demand for the company's stock, pushing its price upward and contributing to overall market growth. On the flip side, if a company's earnings fall short of expectations or show declining profits, investors may lose confidence, sell off the stock, and cause its price to drop, which can negatively impact the market as a whole.

### Interest Rates

Interest rates play a crucial role in shaping the investment landscape. They are primarily controlled by a country's central bank and serve as a tool for managing economic activity. High interest rates make borrowing more expensive for businesses and consumers. Companies face increased financing costs, which can compress their profit margins and reduce future growth prospects. This often makes their stocks less attractive to investors, leading to declining stock prices. In contrast, low - interest - rate environments make borrowing cheaper, stimulating business expansion and consumer spending. This can boost corporate profits and drive stock prices higher.

### Geopolitical Events

Geopolitical events, such as trade wars, elections, and international conflicts, introduce an element of uncertainty into the market. Trade wars, for instance, can disrupt global supply chains, increase business costs, and reduce market access for companies. This uncertainty can lead investors to adopt a wait - and - see approach, reducing their appetite for risk and causing stock market volatility to rise. Elections can also impact the market, as different political parties may have varying economic policies that could affect businesses and the overall economy. The anticipation of policy changes can cause investors to reevaluate their portfolios and adjust their investments accordingly, leading to market fluctuations.

### The Role of Investors

Investors are key participants in the stock market, and their behavior is influenced by the factors mentioned above. They closely monitor economic indicators, corporate earnings reports, interest rates, and geopolitical events to gain insights into potential market movements. Based on this information, investors make buy or sell decisions, which directly impact stock prices and market trends. For example, if investors expect economic growth to accelerate due to favorable economic indicators and low interest rates, they may increase their investments in equities, driving the market upward. Conversely, if they foresee economic turmoil or rising interest rates, they may reduce their exposure to stocks to mitigate potential losses.

In summary, the stock market is influenced by a wide range of factors that are interconnected and constantly changing. Understanding these factors and their relationships is essential for investors to make informed decisions and navigate the complex world of stock market investing.