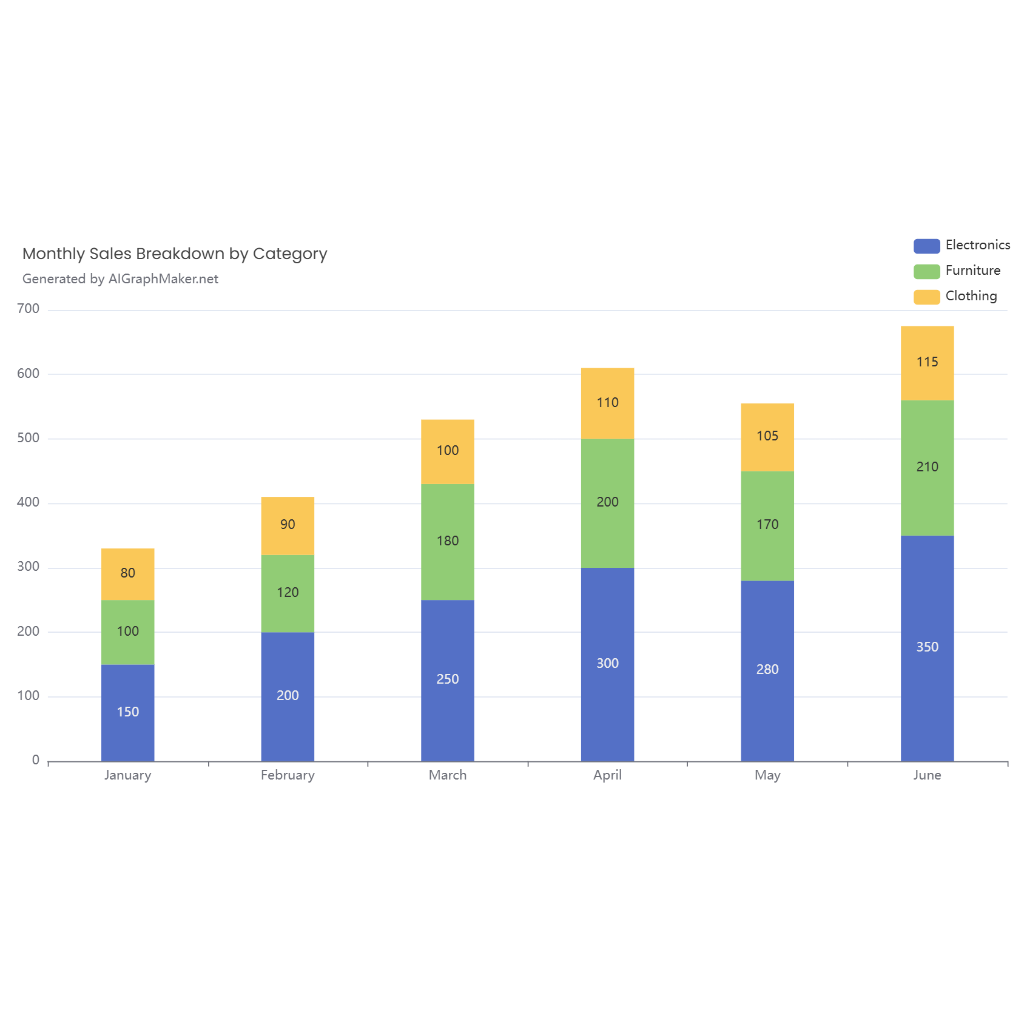

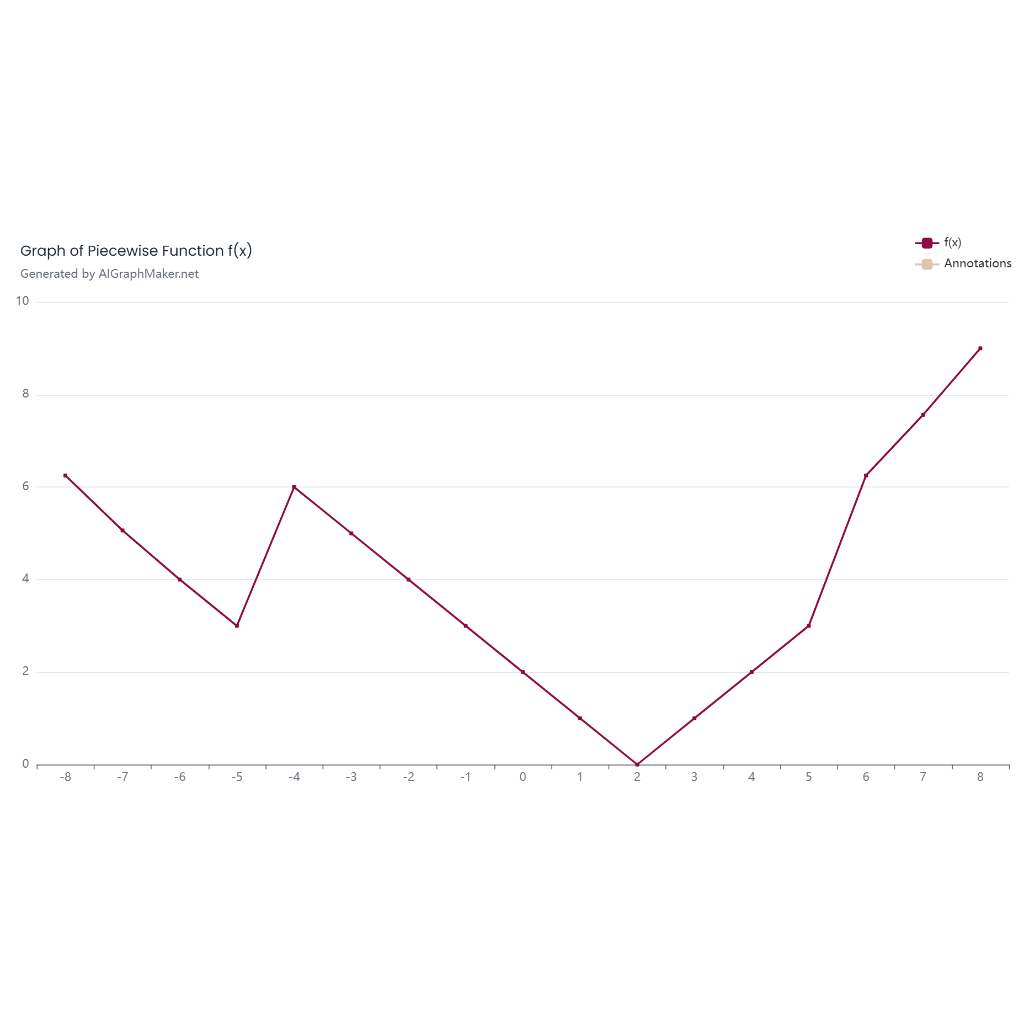

Оформи график на основе данных:

("number of loans issued by MFI M-PESA SHGs FINCA Centenary Bank BRI Mibanco BancoSol CARD MRI Bancamía KOMIDA Agora Microfinance Banco do Nordeste Compartamos Banco")click([1, 6, 3, 0, 8])Based on the available data from various sources, here’s an overview of the microfinance activities and loan disbursements for the mentioned Microfinance Institutions (MFIs) over time:

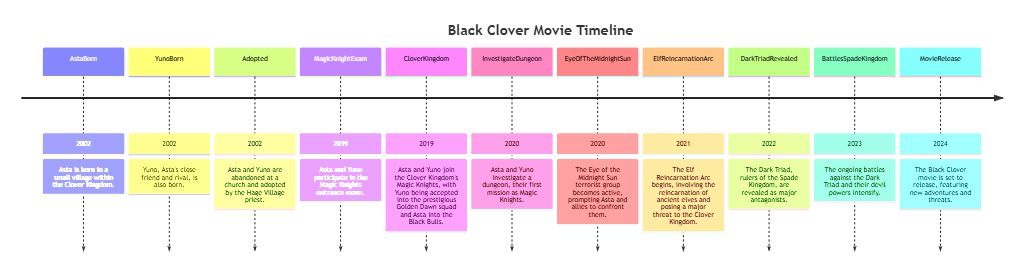

M-PESA (Kenya)**: Launched in 2007, M-PESA revolutionized mobile money and microloans in Kenya, with millions of Kenyans accessing small loans via mobile platforms. The exact number of loans issued is not disclosed annually, but the platform has reached over **30 million users** as of 2024.

Self-Help Groups (SHGs) (India)**: SHGs have been active since the 1980s, and their formalization has dramatically increased the reach of microfinance in rural areas. By 2023, over **30 million SHGs** were linked to the banking system in India, with the total loan outstanding reaching approximately **₹ 3 lakh crore (around $36 billion)**.

FINCA (Uganda)**: Since its formation in the early 1990s, FINCA Uganda has helped more than **1 million clients** access loans. This institution has provided loans to underserved populations, focusing on mobile banking and digital platforms.

Centenary Bank (Uganda)**: This bank is one of Uganda's largest MFIs, reaching over **400,000 clients** with small loans, particularly for rural entrepreneurs.

BRI (Indonesia)**: Bank Rakyat Indonesia (BRI) is one of the largest microfinance banks globally, and by 2023, it had disbursed **over 50 million micro-loans**, with total lending portfolio values reaching around **$9 billion**.

Mibanco (Peru)**: Mibanco has issued over **3 million loans** since its founding in 1998, focusing on the self-employed and micro-entrepreneurs.

BancoSol (Bolivia)**: BancoSol, operating since 1992, has helped more than **2 million people** through its microloans, making it the largest microfinance bank in Bolivia.

CARD MRI (Philippines)**: This group reached over **4 million microfinance clients** by 2023, offering loans to the rural poor, especially women.

Bancamía (Colombia)**: With a mission to support financially excluded populations, Bancamía has disbursed loans to over **1 million clients** by 2024.

KOMIDA (Indonesia)**: A leader in microfinance in Indonesia, KOMIDA has issued **over 500,000 loans** in the past decade.

Agora Microfinance (Zambia)**: Agora Microfinance has issued around **300,000 loans** since its inception.

Banco do Nordeste (Brazil)**: Banco do Nordeste focuses on providing credit to the northeast of Brazil, reaching **hundreds of thousands** of clients with small loans.

Added on:

Mar 02, 2025

User Prompt